The story of the Silicon Valley Bank is by now well known, and the failure of First Republic Bank has become recent news. While the immediate contagion risk has been addressed by aggressive regulatory intervention, the implications for the broader banking industry remain a source of concern for many and we wanted to address the subject and offer our research perspective.

To provide some context and explanation, what follows is more information about the events surrounding First Republic Bank and a review of the downfall of Silicon Valley Bank (SVB).

Update on the Failure of First Republic Bank

Although this is no longer breaking news, very recent to the writing of this piece First Republic Bank (FRB) was taken over by regulators and sold to JP Morgan Chase. While FRB did not share all of the unique characteristics that led SVB to fail (such as aggressive and ill-advised bets on long maturity, highly interest-rate-sensitive bonds), they did see deposits gradually and problematically erode as depositors left for higher rates elsewhere.

Once SVB and Signature Bank failed in March, it sparked broader fears of a banking crisis that can become self-fulfilling and contributed to what happened to FRB: the fleeing of depositors accelerated and aggressive moves to assuage fears, including an influx of $30 billion in deposits from major banks and generous liquidity provided by the Federal Reserve Bank, proved an insufficient match against basic human fear and departing assets.

Fortunately for depositors the many assurances they have been provided in recent months will be upheld. FRB is now a part of JP Morgan Chase and they announced that business will continue uninterrupted. All of FRB’s deposits and its loan portfolio are reported to be part of the deal struck by regulators and JP Morgan Chase, and they communicated there will be no losses for depositors. Losses on the loan portfolio are being shared by JP Morgan Chase and the Federal Reserve Bank (the Fed). (Customers of FRB may have seen this notice from the bank: https://www.firstrepublic.com/resource/message-to-our-clients-chase.)

What’s next? We can expect the Fed and banking regulators to continue to stamp out any new fears that arise through aggressive provision of liquidity and expanded deposit guarantees as deemed necessary. We will continue to assess the situation and will follow up on further developments, but for now wanted to communicate quickly with the basic facts and context.

IMPACT OF UNREALIZED SECURITIES LOSSES ON CAPITAL RATIOS PERCENT

The Leadup & Aftermath of the Silicon Valley Bank Failure

This is adapted and updated from our latest quarterly investment commentary. In a nutshell, SVB was a victim of a classic “bank run,” where depositors en masse seek to withdraw their money but the bank doesn’t have the “liquidity” (the cash on hand) to meet their demands.

Importantly, SVB had unique characteristics that made it particularly susceptible to such a run. This is one reason why we and most economists/analysts do not see this as the beginning of a replay of the Great Financial Crisis (GFC) of 2008. But there clearly will be broader economic and financial market impacts, which we will discuss.

While SVB’s situation was unique, the seeds of the bank run, and the broader banking system stress now playing out, were planted with the Federal Reserve’s unprecedented monetary policy stimulus (quantitative easing and zero interest rates) in the years following the GFC and then turbocharged by the pandemic stimulus. The damage has come from the Fed embarking on its most aggressive monetary policy tightening in 50 years – hiking interest rates from 0% to 4.75% over the past 12 months.

As all bond investors painfully experienced last year, sharply rising interest rates caused sharp declines in core bond prices (the worst price declines in U.S. bond market history). This included Treasury bonds and government agency mortgage-backed securities (MBS) – where many banks invested some of their customers’ deposits.

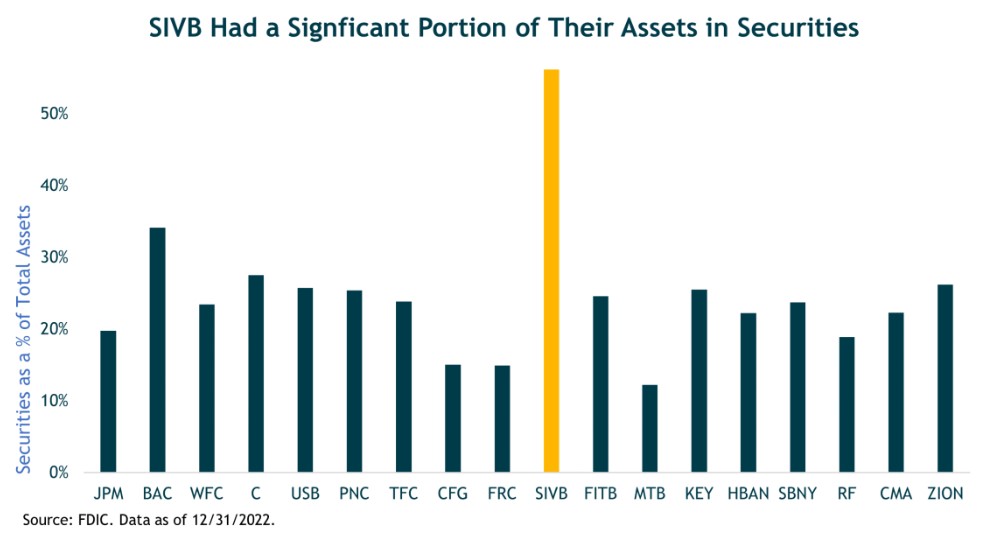

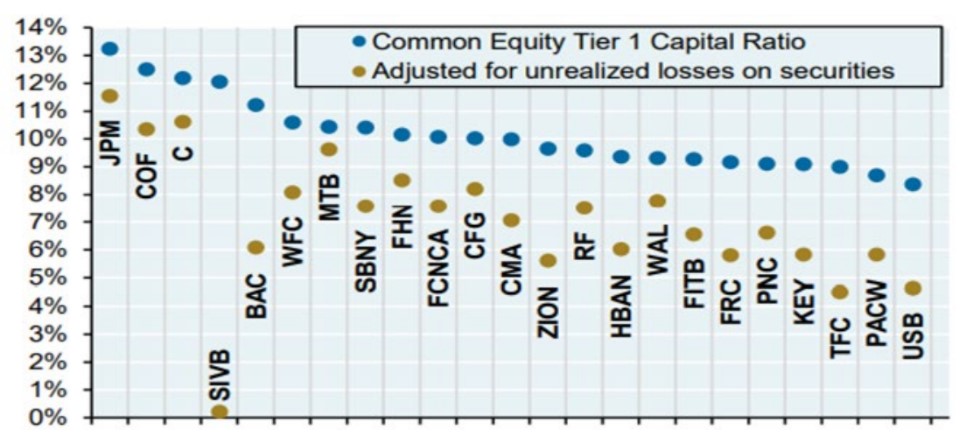

All banks’ bond-holdings have been hurt by the sharp rise in rates/falling bond prices, but SVB was particularly exposed to this interest-rate risk (or bond “duration risk”) as the charts below show. SVB held an unusually large share of its assets in bonds, and those bonds had particularly long duration (a measure that implies the sensitivity of a bond’s price to changes in interest rates) i.e., they had a lot of duration risk, meaning their prices (values) were highly sensitive to changes in interest rates. As such, SVB faced extremely large unrealized losses on their bond portfolio, which the bank had purchased when interest rates were much lower/prices were much higher.

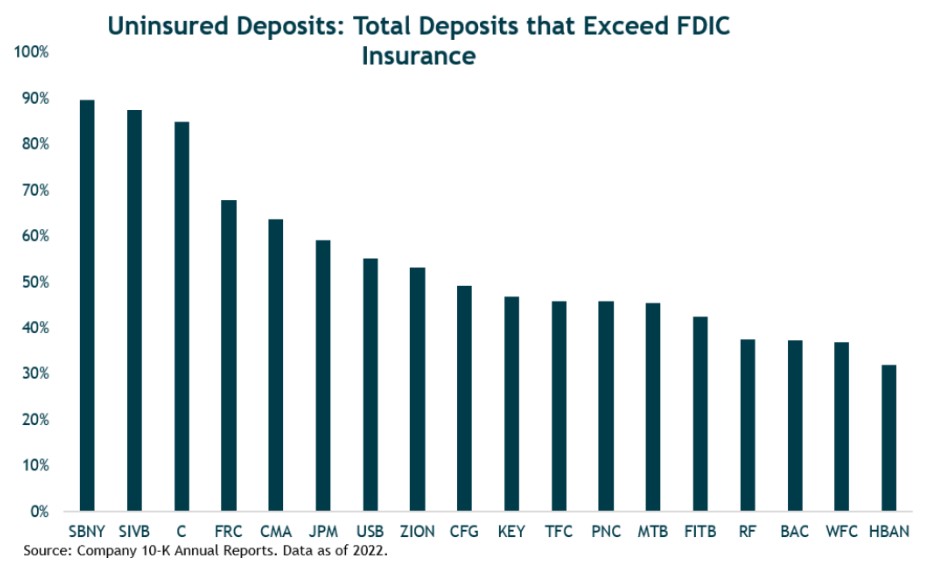

But that’s not all. In addition to SVB’s huge exposure to unrealized losses in its bond holdings, it also had two other unique susceptibilities to a bank run: (1) a highly concentrated depositor base comprised of start-up tech, venture capital firms and the like; and (2) almost its entire depositor base was above the FDIC insurance coverage limit of $250,000 per account. As shown in the chart below a whopping 90% of SVB’s total deposit base was FDIC uninsured at year-end 2022. (Note that Signature Bank of NY (SBNY), the other regional bank taken over by the FDIC, also had roughly 90% of uninsured deposits.)

Combined, these characteristics of SVB caused some of their concentrated, large, uninsured depositors to start pulling their money from the bank, which in turn forced SVB to raise capital (liquidity) to meet the withdrawals, which meant SVB had to sell bonds at losses (and/or raise equity capital), turning the unrealized losses on their balance sheet into realized losses, raising the question of not only liquidity risk for the bank but solvency/bankruptcy risk, leading to even more depositor flight, etc., until the FDIC and Fed stepped in over the weekend of March 11 to take over the bank, guarantee all SVB deposits above $250,000, and set up a broad banking system liquidity backstop (the Bank Term Funding Program (BTFP)).

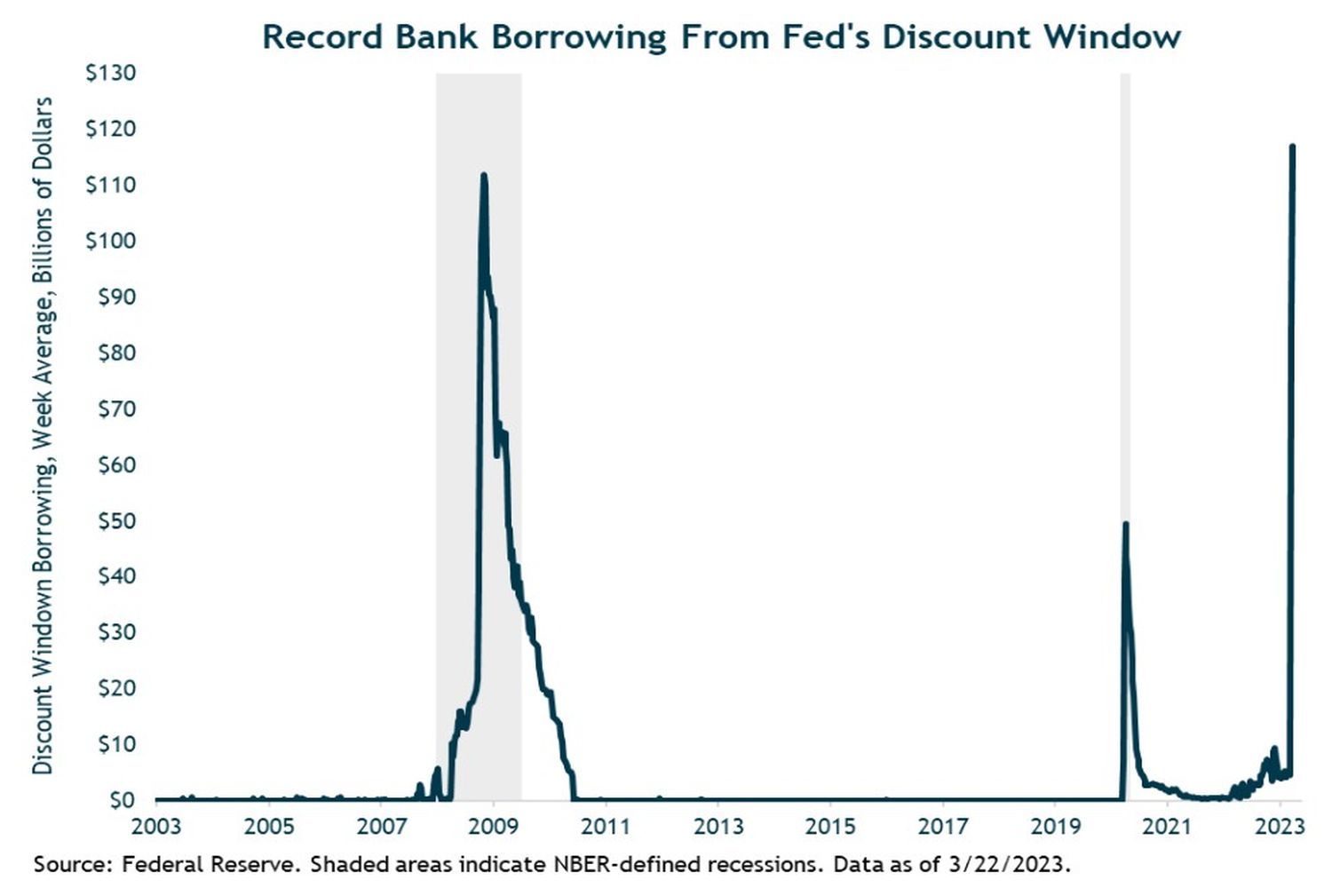

The BTFP allows banks to borrow from the Fed for up to a year, based on the issued face value (par value) of their Treasury bonds and agency MBS, rather than the current (lower) market value. This new facility, as well as the Fed’s decision to ease the lending terms on its existing “discount window” short-term (90-day) lending facility, enables banks to meet deposit withdrawals and other liquidity needs without having to sell currently underwater bonds at a loss. As the chart below shows, banks have taken the Fed up on its offer, and then some.

While the banking system is not out of the woods and there may be more smaller-bank takeovers, it seems these steps and subsequent actions from authorities have stemmed the risk of a widespread bank-run contagion.

More broadly, as to why we don’t see this as likely the beginning of “GFC 2.0,” we’d highlight the following key differences between now and then:

(1) The GFC was the result of a self-reinforcing negative spiral involving credit risk and counterparty risk. Banks and other financial institutions lent hugely to unqualified borrowers (e.g., NINJA mortgages to homeowners with no income/no job/no assets) and the systemic risk was multiplied by the pervasive creation of financial derivatives based on such shoddy loans (and even derivatives on the derivatives). As housing prices fell, the value of these loans collapsed and banks had insufficient capital to handle the declines. This led to a credit crunch, which further fed the housing price decline and economic downturn, leading to further losses on loan values, further bank insolvency, etc.

This time, the problem is not caused by poor lending standards (credit risk), exploding derivatives and weak bank balance sheets (although poor management of the failed banks is a common theme), but instead interest rate duration risk from the banks’ Treasury and agency bond holdings, whose values plunged as interest rates soared. There is no risk of default – no credit risk – in Treasuries and government agency MBS.

Further, in the current situation, as core bond yields have subsequently fallen in response to risk aversion and macro fears caused by the SVB crisis, the value of banks’ high-quality bond holdings have increased (unrealized losses have lessened). So, this seems more of a self-limiting feedback loop, very different from the self-perpetuating adverse feedback loop of the GFC.

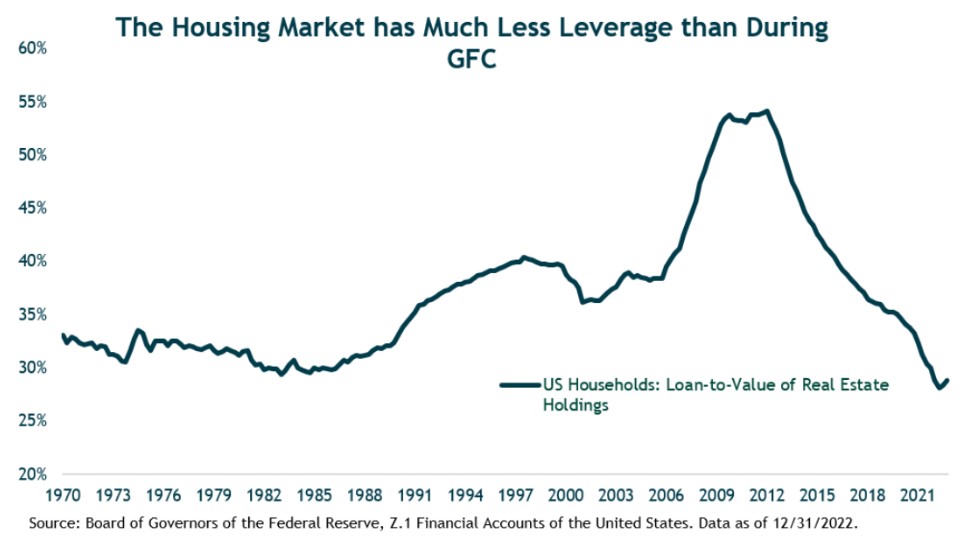

(2) U.S. consumers in aggregate are now less leveraged and lending standards were tightened, especially in the housing market where regulations since the GFC have reduced loan-to-deposit ratios and raised loan qualification standards.

(3) Banks are better capitalized now, particularly the very largest “systemically important” banks, due to tighter regulations since the GFC.

(4) Having lived through 2008, the authorities (Fed, FDIC, Treasury) have acted relatively quickly and forcefully to stem the systemic contagion risk. While the likelihood of a repeat of the 2008 financial crisis is unlikely for all these reasons, there will likely be an ongoing impact from the sharp rise in rates that led to the Silicon Valley Bank takeover. The decline in many bank stocks may have been triggered by the short-term contagion fear, but through a more analytic lens, the repricing reflects the market’s appreciation that higher rates will hurt many banks’ earnings even if their solvency is not in question.

When managing client investment portfolios, we don’t make tactical bets on sectors. In other words, we don’t overweight or underweight financial services or banking stocks, but we do analyze broadly the impact of higher interest rates on the risk and return potential for our portfolios. While the issues surrounding Silicon Valley Bank and First Republic Bank are concerning, at this point, we haven’t made any changes to our investment outlook or portfolio positioning. As always, we remain highly engaged and open-minded as events unfold, and if anything changes in our analysis, we will, of course, share it with you.

Please feel free to reach out if you have any questions.