Market Recap

Despite the stress in the banking system, including the failure of Silicon Valley Bank, global equity markets held up remarkably well in March and posted solid returns for the quarter. The S&P 500 index was up 3.7% in March and gained 7.5% in the first quarter. Developed international stocks (MSCI EAFE Index) did a bit better, rising 8.5% for the quarter (and returned 2.5% in March). Emerging markets stocks (MSCI EM Index) gained 4% for the quarter and rose 3% in March.

Underneath the calm market surface there was wide dispersion in returns across sectors, market caps and styles. Large-cap growth stocks (Russell 1000 Growth Index) gained 14.4% in the quarter, while the large-cap value stocks returned 1% (Russell 1000 Value Index). The Nasdaq Composite Index surged 17%, while the Russell 2000 Small Cap Value Index dropped 0.7%.

Fixed-income markets had a strong quarter as longer-term bond yields fell, generating price gains. Core investment-grade bonds (Bloomberg U.S. Aggregate Bond Index) returned 3%, as the 10-year Treasury yield fell to 3.5% from 3.9% at year-end. Riskier high-yield bonds (ICE BofA U.S. High Yield Index) outperformed core bonds gaining 3.7%. Municipal bonds gained 2.3% (Morningstar National Muni Bond Category). Flexible/nontraditional bond funds gained around 3%.

Alternative strategies and nontraditional asset classes generally underperformed traditional stock and bond indexes for the quarter. Trend-following managed futures strategies had a particularly tough period, losing anywhere from 6% to 10%, as some of the major trends from 2022 sharply reversed – particularly interest rates.

Quick Recap: The Silicon Valley Bank Failure – What happened and why it is not the beginning of another financial crisis

By now, the story of the Silicon Valley Bank (SVB) failure is well known. But we think a quick recap is worthwhile as it provides context for our investment outlook and portfolio positioning that follow.

In a nutshell, Silicon Valley Bank was the victim of a classic “bank run” – too many depositors wanted their money back simultaneously and SVB didn’t have the cash on hand to meet customer withdrawals.

Importantly, SVB had unique characteristics that made it particularly susceptible to such a run that don’t necessarily apply to the broader banking industry, or at least to the same degree. This is one reason we do not see the failure of SVB as the beginning of a replay of the Great Financial Crisis (GFC) of 2008. But there clearly will be broader economic and financial market impacts.

SVB was particularly exposed to interest-rate risk as it held an unusually large share of its assets in long-duration bonds. As such, SVB faced extremely large unrealized losses on their bond portfolio when rates rose sharply last year as the Fed sought to choke off inflation. Moreover, unlike most banks with a diversified deposit base that includes individuals of all sizes and types of businesses in different sectors, SVB’s depositor base was comprised of start-up technology, venture capital firms and the like; and almost its entire depositor base was above the FDIC insurance limit of $250,000 per account.

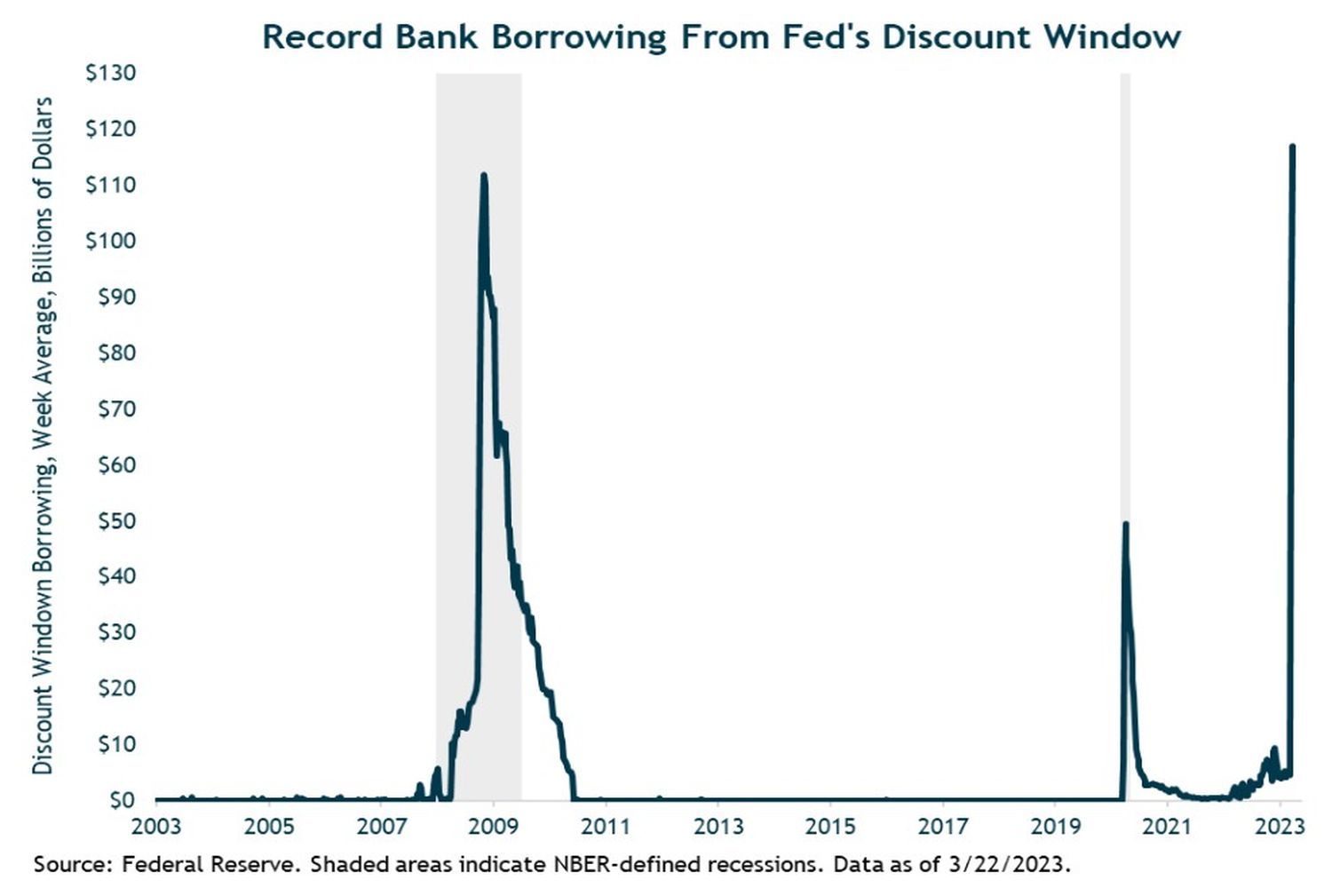

Combined, these characteristics of SVB caused some of their concentrated, large, uninsured depositors to start pulling their money from the bank. This forced SVB to raise capital (liquidity) to meet the withdrawals by selling bonds at losses, turning the unrealized losses on their balance sheet into realized losses, raising the question of not only liquidity risk for the bank but solvency/bankruptcy risk, leading to even more depositor flight, etc. Ultimately, the FDIC and Fed stepped in over the weekend of March 11 to take over the bank, guarantee all SVB deposits above $250,000, and set up a broad banking system liquidity backstop (the Bank Term Funding Program (BTFP)). The BTFP allows banks to borrow from the Fed for up to a year, based on the issued face value (par value) of their treasury and agency MBS bonds, rather than the current (lower) market value. This new facility enables banks to meet deposit withdrawals and other liquidity needs without having to sell currently underwater bonds at a loss. As we can see in the chart below, banks have taken the Fed up on its offer, and then some.

While the banking system is not out of the woods and there may be more smaller-bank takeovers, it seems these steps and subsequent actions from authorities have stemmed the risk of a widespread bank-run contagion.

Investment Outlook and Portfolio Positioning

We always consider a range of macroeconomic scenarios when constructing our investment views and diversified portfolios. Our approach is particularly valuable during periods of heightened uncertainty, which we would argue is the case today given the dynamics of inflation, fed policy, and stress in the banking system.

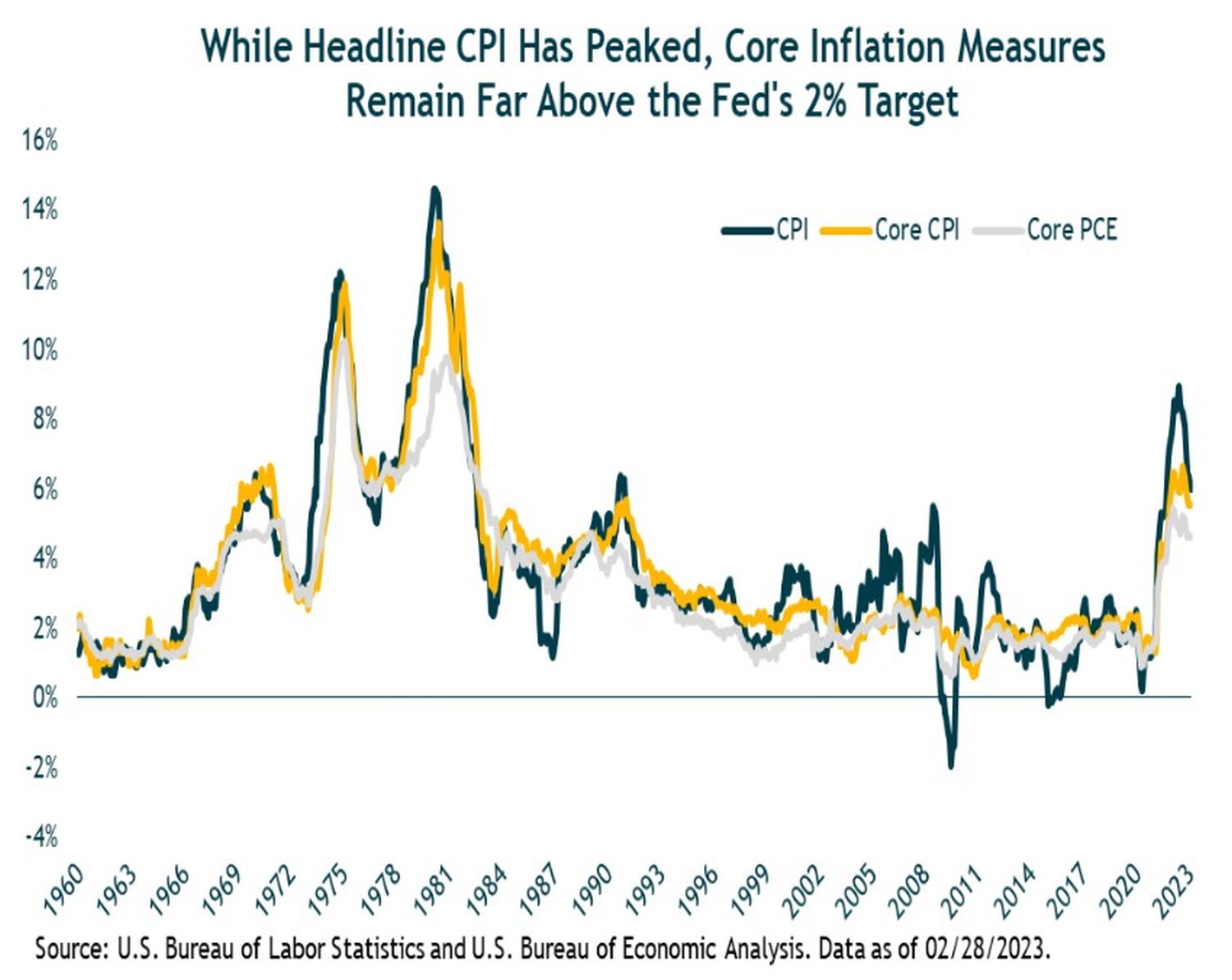

On the inflation front, while inflation likely peaked last year and has come down, it remains too high relative to the Fed’s 2% long-term target. February’s year-over-year core CPI inflation rate was 5.5%, while core CPE inflation – the Fed’s preferred measure – clocked in at 4.6%.

Given persistently high inflation, the Fed has continued its rate hiking campaign this year, although the magnitude of rate hikes has diminished.

At its March 22 FOMC meeting, the Fed hiked its federal funds policy rate by 25 basis points (0.25%) to a range of 4.75% to 5.0%. This was the Fed’s ninth consecutive hike since March 2022, representing a total tightening of 475bps (4.75 percentage points). This is the most aggressive monetary policy tightening campaign since the Paul Volcker days in the early 1980s. It was inevitable something (in this case SVB and other poorly managed banks) would “break” given the magnitude and speed of the hikes.

The Fed is still hoping they can land the economy softly without causing much more damage, let alone a recession. It’s not impossible, but the odds are low and history is not on their side given the complexity of the task and the multitude of economic and behavioral variables outside of their control.

With above-normal inflation and the Fed sharply tightening, the short-term outlook for economic growth was already poor coming into the year. Add to that the negative impact from tighter credit conditions due to the recent banking stress, and the growth outlook has gotten worse. How much worse isn’t clear. But it definitely hasn’t improved the chance of avoiding a recession this year.

However, all is not gloom and doom for the economy. Household and business balance sheets remain healthy and supportive of continued spending. U.S. households are still sitting on an estimated $1.4 trillion in pandemic-era savings. Employment remains robust, with a stronger than expected 311k new jobs in February, following the shockingly strong 504k jump in January. Real disposable income is rising as wage growth is now stronger than CPI inflation. Moreover, the U.S. and other major global economies appear to have grown in the first quarter of the year. So even if a recession does play out, these are all reasons to believe it may be relatively mild.

In an economic recession, it is almost certain corporate earnings will decline. S&P 500 index earnings typically decline around 15% to 20% (peak-to-trough) during economic recessions as both sales growth and profit margins compress. In a mild recession, the earnings decline might be closer to 10% to 15%. Yet, the current consensus earnings expectations for 2023 do not reflect nearly that magnitude of decline; nor do current stock market valuations. If our base case earnings recession scenario plays out, there is a strong likelihood that the S&P 500 index will materially decline from current levels.

Longer term, our current base case five-year expected return estimates for equities is for mid-single digit annualized returns over the period, which assumes a recessionary bear market happens. This is a decent but not great expected return for U.S. stocks given their risks. It is also well below our five-year return expectations for developed international and emerging markets (EM) equities of high single to low double-digit annual average returns.

Valuations for Foreign Stocks are Attractive

Among the three regions, we tactically favor EM stocks right now based on their higher expected returns, which are a function of what we expect will be faster sales growth and improving profit margins over the next several years. This comes after more than 10 years of stagnant EM earnings growth. We also expect some narrowing of the historically large valuation discount between EM and US indexes.

Finally, we expect the U.S. dollar to decline versus most other currencies over the medium-term, which would further add to EM and international equity returns for dollar-based (unhedged) investors. When the U.S. stock market declines to levels that offer more compelling medium-term returns and adequately discount shorter-term risks, we will look to add back exposure by selling more-defensive assets (bonds).

In addition to our core bond exposure, we continue to have a meaningful allocation to higher-yielding, actively managed, flexible bond funds run by experienced teams with broad investment opportunity sets. There are many fixed-income sectors outside of traditional core bonds that offer attractive risk-return potential, and we want to access them via our active managers.

Finally, we maintain core positions (4% in a typical balanced portfolio) in trend-following managed futures funds. We believe they offer powerful long-term portfolio benefits in providing alternative and non-correlated returns relative to traditional stock and bond holdings. They can perform well whether the macro backdrop is deflationary, inflationary, stagflationary, or growth-oriented. Our conviction in owning these strategies remains high.

Closing Thoughts

We believe 2023 will present us with some excellent long-term investment opportunities. Unfortunately, in our base case we also expect we’ll first have to go through a recessionary bear market with a likely meaningful drop in global equity prices. While a recessionary bear market is our base case, we do not rule out the possibility the U.S. economy avoids recession this year, or that the recession is mild, and stocks do not drop as sharply as we expect.

A lot still depends on the Fed and how much further they tighten (raise rates). If the Fed pauses their hiking campaign sooner than later, equities may positively respond (at least over the short-term), as lower interest rates imply higher P/E multiples. But there are numerous other key variables for the economy and financial markets that are beyond the Fed’s or any policymaker’s control. The recession may be pushed out to 2024 but we doubt it’s been rescinded.

Even with a recession as our base case near-term scenario, we currently see attractive medium-term expected returns from international and emerging markets stocks – better than what we expect from the U.S. market. As such, we have a relative overweighting to equities outside the U.S.

Fixed-income assets and high-quality bonds are also now attractively priced with mid-single digit or better expected returns, depending on duration and credit quality. Core bonds will also provide valuable portfolio ballast in the event of a recessionary bear market. Our investments in alternative strategies and managed futures funds should provide further resilience to our portfolios.

As always, we appreciate your continued trust and confidence.