Market Recap

What a difference a year makes. In 2022, high inflation and the Fed’s commitment to tame it, led to sharply rising interest rates and negative returns for both stocks and bonds. In 2023, much to the surprise of many forecasters, global stock and bond markets ignored widespread expectations that we were headed for a recession and were able to shake off a host of uncertainties to post strong gains for the year.

Aided by a powerful year-end rally, U.S. stocks (S&P 500 Index) jumped nearly 12% in the fourth quarter to finish up 26% for the year, and end within a whisper of its all-time high. Smaller-cap stocks (Russell 2000 Index), which lagged their larger counterparts for most of the year, also rallied sharply in the fourth quarter (+14%) to end the year with a respectable gain of 17%.

Developed International and emerging-market stocks also posted solid gains. Developed International stocks (MSCI EAFE) finished the year up 18%, while emerging-market stocks (MSCI EM Index) posted a nearly 10% return.

Bonds also rallied sharply in the fourth quarter aided by a significant drop in Treasury yields. The benchmark 10-year Treasury yield declined over 100bps in the fourth quarter resulting in a 6.8% return for the Bloomberg U.S. Aggregate Bond Index. Interestingly, despite massive intra-year volatility, the 10-year Treasury yield ended the year exactly where it started. For the year, U.S. core bonds (Bloomberg U.S. Aggregate Bond Index) finished up 5.5%. Credit was a standout performer both in the fourth quarter and for the full year. High-Yield bonds (ICE BofA High Yield Index) were up 7% in the quarter, finishing up 13.4% for the year.

Our portfolios generated solid returns across the board, powered by allocations to flexible bond funds and strong active equity manager performance.

Investment Outlook and Portfolio Positioning

Looking ahead to 2024, all eyes will continue to be on the Fed. When will the Fed start to cut rates, by how much, and why? Will the Fed cut rates enough to meet the markets’ lofty expectations? While these questions will be in focus, monetary policy is just one of many factors that will influence markets. Geopolitical risk, the U.S. presidential election, labor markets, and inflation will likely fill the headlines and all could be sources of volatility.

From an economic perspective, we enter the year on solid footing and believe a recession is unlikely in the first half of 2024. There are several factors supporting solid economic and corporate earnings growth, while inflation continues to decline. We think the biggest recession risk will come from weakness among consumers in the latter half of the year and we will continue to closely monitor economic data and adjust our views accordingly.

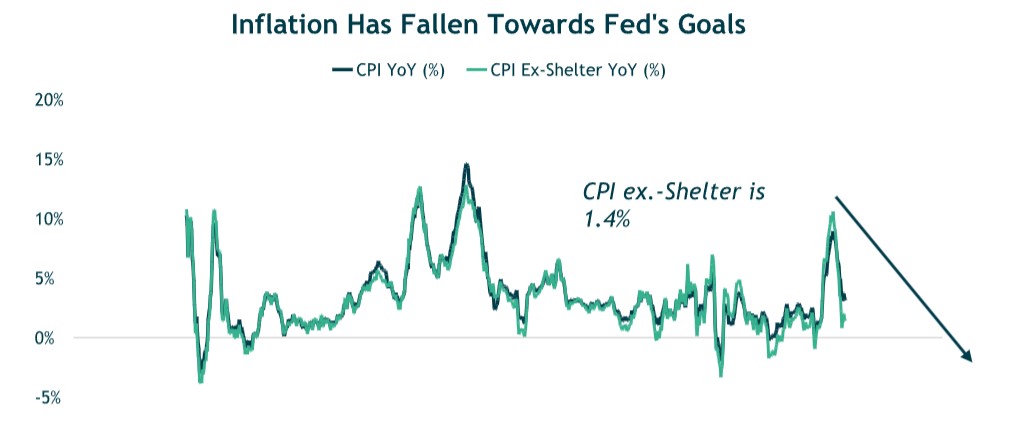

As we stated in our third-quarter commentary, we thought the Fed had the upper hand on inflation and that it would continue to trend lower. That has been playing out and we continue to believe that inflation will grind lower in the near term. Many of the metrics we observe suggest that inflation is already at or below the Fed’s target.

The chart below illustrates the year-over-year inflation rate and year-over-year inflation rate excluding shelter costs, which is a key CPI input. (It makes up about 30% of the CPI.) While year-over-year inflation recently came in at 3.1%, this number drops to 1.4% when excluding shelter. These levels are near the Fed’s goals, which suggests that the Fed’s policy has been working, and with time inflation could continue to fall, particularly if shelter continues to decline.

Source: U.S. Bureau of Labor Statistics. Data as of 11/30/2023.

Since the Fed started their aggressive tightening cycle, the debate has been about the odds of a “soft landing” or “hard landing” for the economy. In other words, would the Fed be able to thread the monetary policy needle and raise interest rates enough to stamp out inflation, but not so high it slams the brakes on the economy and tips it into recession.

The National Bureau of Economic Research (NBER) is the scorekeeper when it comes to determining recessions. Their definition of a recession is a “significant decline in economic activity that is spread across the economy and that lasts more than a few months.” The business cycle since the onset of the pandemic has been anything but ordinary. Instead of a simultaneous and broad-based decline in economic activity, we’ve observed specific industries struggling with isolated declines over time, while the broad economy has managed to stay afloat.

Throughout 2020, Covid had an unprecedented impact on societies around the world. Many non-essential service-oriented businesses such as air travel and tourism experienced a depression-like scenario as demand evaporated. Conversely, goods-related businesses experienced a boom. Then through 2021 and 2022, consumer habits flipped and demand for services surged as economies around the world re-opened. As inflation took hold and interest rate increases became inevitable, rate-sensitive areas of the economy contracted. The housing market froze, and a higher cost of capital for technology firms caused funding to dry up and there were layoffs across the sector. In 2023, we have seen regional banks and commercial real estate face declines.

Indeed, the most anticipated recession ever has yet to happen. Many economists now expect it to happen in the second half of this year. With various sectors of the economy experiencing contractions at different times over the last few years, we would anticipate more of a mild slowdown, not a deep economic downturn across sectors. But of course, we will be closely monitoring corporate earnings, labor statistics, and financial conditions to best assess the ultimate type of “landing.” There is growing consensus that a “soft landing” may occur in the U.S. in 2024, and we are not ruling that out, especially if the Fed cuts rates sooner than later. That said, we recognize that soft landings are quite uncommon, occurring only four times in the last 75 years.

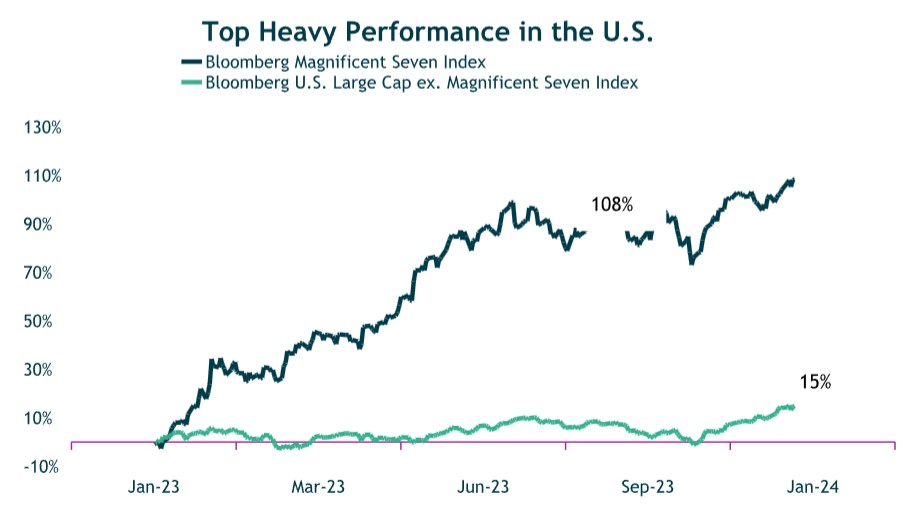

Within the U.S. stock market, performance in 2023 was driven by the handful of mega-cap growth stocks, dubbed the “Magnificent 7” (Apple, Microsoft, Nvidia, Facebook, Alphabet, Netflix, Amazon). These stocks had an average return in excess of 100% for 2023 and now represent a combined weight of more than 28% in the S&P 500 and 47% in the Russell 1000 Growth Index – near historic highs. However, much of the return in these stocks were driven by expanding valuation multiples leaving them expensive relative to the broader market.

With the market confident that interest rates have reached their cyclical peak, we also saw a shift in market leadership with equity gains broadening out beyond the “Magnificent 7.” As seen in the chart above, the remaining 493 stocks in the S&P 500 index rallied 15% to end the year. We believe the recent broadening out of equity performance has the potential to persist over the course of 2024, and we could see areas of the market that have significantly lagged perform much better. For example, small-cap stocks beat large-cap stocks and value stocks outperformed growth stocks late in the year. We anticipate rebalancing portfolios away from the big winners of 2023 and towards higher quality, more attractively valued strategies that could perform well in periods of heightened volatility or an economic slowdown.

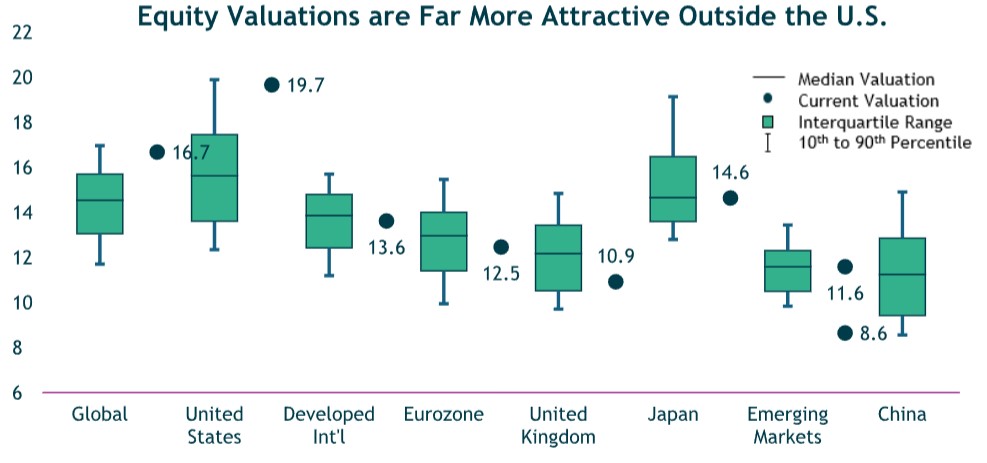

Our overall equity allocation continues to favor another unloved segment of the market – foreign stocks. Heading into 2024, the valuation discount for developed international and emerging-market stocks versus the U.S. is the widest it’s been in decades. From 2006 through 2016, the U.S. and developed markets traded within one multiple point of each other. The average forward P/E for the S&P 500 over the period was 14x compared to 13x for MSCI EAFE. Since 2016, the valuation gap has widened substantially. The S&P 500 now trades at nearly 20x forward earnings while the MSCI EAFE remains close to 13x. The story can be seen in the chart below—U.S. stocks trade toward the top end of their valuation range while other regions offer up better relative values. Most other markets are trading roughly in-line or slightly below their historic averages. All else equal, lower starting valuations imply better long-term expected returns and provide more of a valuation cushion should multiples contract in a stock market sell-off.

We remain positive on Core Investment Grade bonds (Bloomberg U.S. Aggregate Bond index). Within credit, we believe fundamentals remain relatively healthy despite higher debt costs. Interest coverage, the level of leverage, and cash levels all look better than in historical periods late into a rate cycle but acknowledge this is factored into today’s valuations. And, as we’ve stated for several quarters now, bond investors continue to benefit from higher starting yields. Core Investment Grade bonds are currently yielding 4.5%, which is above the current 3.1% inflation level, so bonds are providing a positive real (after-inflation) yield. Finally, we believe core bonds will provide downside mitigation in the event of a recession or decline in the stock market.

In addition to core bonds, we continue to have meaningful exposure to higher yielding, actively managed, flexible bond funds run by experienced teams with broad opportunity sets. There are several fixed-income sectors outside of the traditional parts of the bond market that provide attractive risk-return potential, and we access them through active managers. Some of these funds are currently yielding in the high single digits, while maintaining an eye on capital preservation. In fact, some of our bond holdings have incrementally become defensive through the year.

Closing Thoughts

We think it is quite possible that 2024 will be a year where investors again enjoy some of the classic underpinnings of investing, where stocks and bonds are less correlated and provide diversification benefits to portfolios. This was not the case in 2022 and 2023, when stocks and bonds both declined meaningfully and then posted gains.

While there are likely to be bouts of volatility, these inevitably create opportunities. Currently, we see opportunities within the stock market, particularly as we expect a broadening out into areas of the market that have lagged. Within fixed income, we believe that rates have peaked, inflation is under control for now, and that interest rates will decline though not back to zero. In this environment we continue to take advantage of the inverted yield curve, capturing higher yields from shorter-term securities, while also benefiting from more attractive yields across the bond market. We will also look for any opportunities that arise as a result of the Fed not meeting market expectations around the timing and magnitude of rate cuts.

Thank you for your continued trust and confidence.