Market Recap

The S&P 500 reached a 2023 high at the end of July before selling off 7.5% through August and September to finish the quarter down 3.3%. Year-to-date the index remains up a solid 13%. Smaller-cap stocks (Russell 2000) also had momentum early in the quarter but changed course and ended the quarter down 5.1%, though are still positive 2.5% year-to-date.

Within foreign markets, developed international stocks (MSCI EAFE) declined 4.1% in the quarter yet remain up just over 7% year-to-date. Emerging market stocks (MSCI EM) fell 2.9% bringing down their year-to-date return to just under 2%. The U.S. dollar (DXY Index) climbed over 3% during the quarter, resulting in a headwind for foreign stock returns.

In bond markets, the 10-year Treasury yield climbed nearly 70bps in the quarter, ending the period at 4.59% – the highest point since before the financial crisis in 2008. As a result, core bonds (Bloomberg U.S. Aggregate Bond Index) fell sharply, declining 3.2% over the quarter. High-yield bonds (ICE BofA US High Yield) managed to eke out a small quarterly gain and are up 6% year-to-date.

Finally, multi-alternative strategies (Morningstar Multistrategy Category) and managed futures (SG Trend Index) demonstrated their diversification benefits. Multi-alternative strategies returned 0.2% and managed futures gained 1.15% in the quarter.

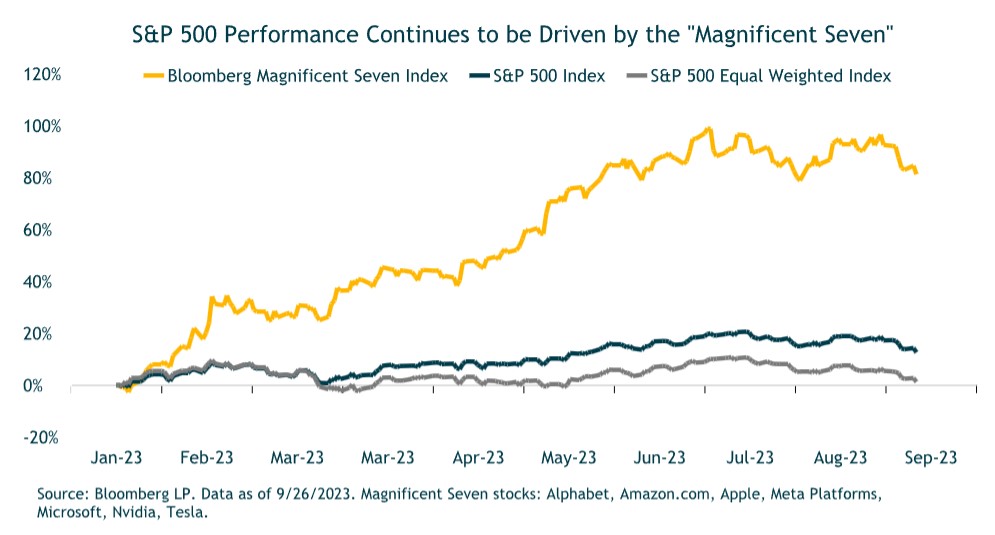

The “Magnificent Seven” Continue to Power U.S. Equity Returns

With virtually all segments of the stock market posting gains this year through September, one might think that we’re in the midst of a broad-based rally. However, stock gains have remained unusually narrow, with the largest stocks in the index leading the way. The standout performers are those sectors with the largest stocks, while most other sectors have been relatively flat. Consumer discretionary has been driven higher by a 51% gain from Amazon.com and a 103% return from Tesla. The information technology sector has outperformed thanks to Apple (+32%), Microsoft (+33%) and NVIDIA (+198%) year-to-date. Communication services has been propelled higher by a 48% return for Alphabet (Google) and 149% from Meta Platforms (Facebook).

Despite stalling in the latter half of the third quarter, the year-to-date performance of the “Magnificent Seven” stocks continues to explain most of the U.S. stock market’s returns. These seven stocks have increased collectively more than 80% this year, while the remaining 493 stocks in the S&P 500 are basically flat.

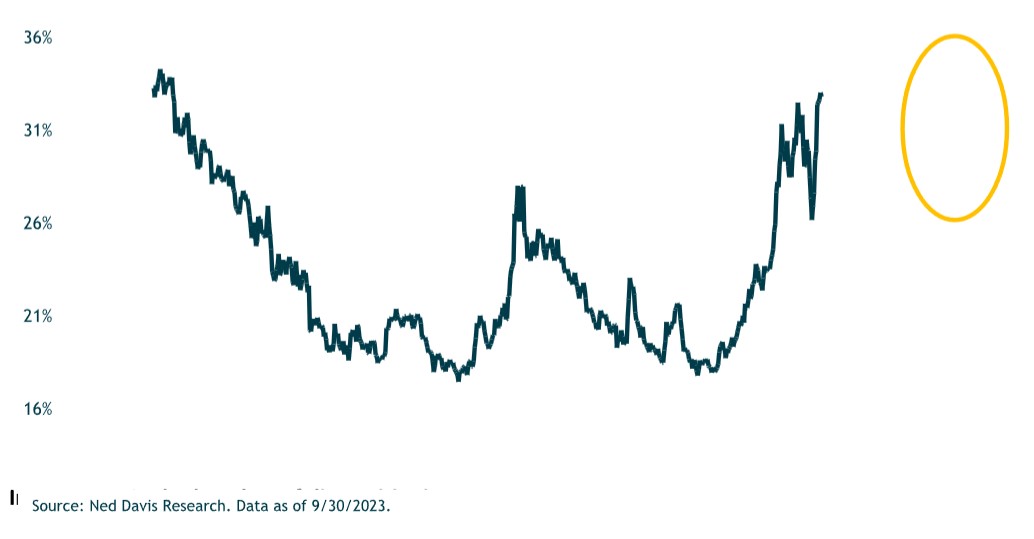

As a result of their massive outperformance, the “Magnificent Seven” have a combined $10.7 trillion market cap and constitute more than 30% of the S&P 500 index. This level of concentration at the top of the U.S. market exceeds what was witnessed in 2021 and the tech bubble of the late 1990’s / early 2000’s. We have to travel all the way back to the early 1970’s (remember the “Nifty Fifty”?) to see a market as concentrated as it is today.

Investment Outlook and Portfolio Positioning

From a macroeconomic perspective, the big question remains whether the U.S. economy can avoid recession or not, and the timing if it does occur. It goes without saying that the answer will likely lead to meaningfully different market outcomes. If the Fed can manage to slow the economy while avoiding recession, we would expect to see the market’s gains broaden out beyond the large-cap technology-related sectors. Conversely, if the Fed’s monetary tightening cycle leads to recession, it would likely lead to broader-based declines.

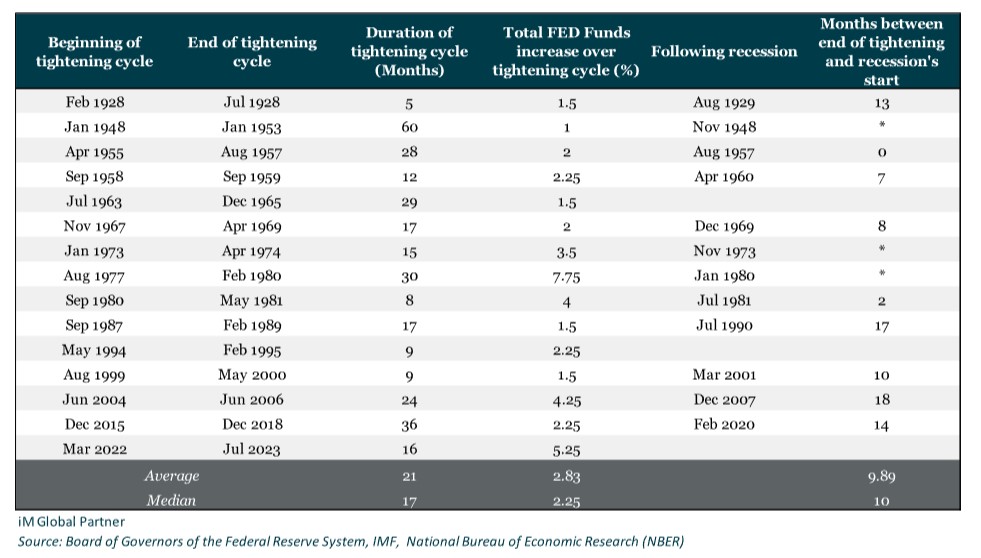

There are reasons to be cautious – our base-case is for a mild recession looking out to 2024. We have seen one of the quickest and sharpest tightening cycles in history, and lending standards have tightened considerably. Both factors create recessionary conditions, particularly as the Fed has a history of raising rates too far, tipping the economy into recession. Since 1931, there have been 19 hiking cycles and in only three instances did the economy avoid a recession (below).

However, on the positive side, if the economy falls into recession, we believe it will be relatively mild. One consideration is that the economy has been experiencing a “rolling recession” where slowdowns are spread across industries over time, dampening the impact compared to a recession when industries experience a simultaneous slowdown all at once. For example, housing has already experienced a slowdown and detracted from GDP for several consecutive quarters. In the tech sector, layoffs have already occurred. Finally, a perhaps counterintuitive point is that this recession has been so widely anticipated for so long now, it may actually reduce the risk of a deep recession. Going back to 2022 and early 2023, the press termed this the “most-anticipated recession ever.” Amid all this built-up anticipation, some companies, have already laid off workers and slowed hiring. These corporate moves help loosen the labor markets and potentially ease inflationary pressures.

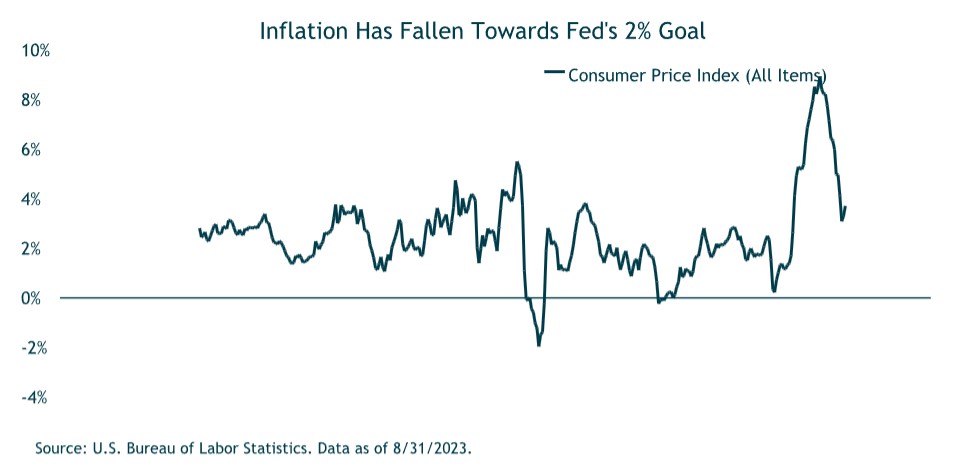

Speaking of inflation, it has come down meaningfully from its June 2022 high of 9.1%, thanks in part to the Federal Reserve’s rapid rate hikes. The chart below illustrates year-over-year inflation data, which recently declined to 3.7%, and suggests the Fed’s policy has been working and with time inflation could continue to fall.

At this point, it is clear the rate-hike regime is close to an end and we believe the Fed has gotten the upper hand on inflation. The aggressive hiking cycle that started roughly 18 months ago was finally put on pause in late-July—although one more 25 basis point hike could still happen. Since March 2022, the Federal Reserve increased rates from zero to a target level of 5.25%-5.5%.

The rise in interest rates has taken a bite out of bond returns, which have suffered steep losses over the past couple years. The silver lining is that looking forward, interest rates (and bond yields) ended the third-quarter at levels not seen in nearly 20 years (the Bloomberg Aggregate Bond Index ended the quarter yielding 5.4%). Higher starting yields, all else equal, should lead to higher expected returns. We remain positive on core bonds given their combination of healthy fundamentals, attractive current yields, and the downside protection they provide portfolios in the event of a recession.

In addition to core bonds, we continue to have meaningful exposure to higher-yielding, actively managed, flexible bond funds run by experienced teams with broad opportunity sets. There are several fixed-income sectors outside of the traditional parts of the bond market that provide attractive risk-return potential. Some of these funds are currently yielding in the high single digits, while maintaining an eye on capital preservation and interest rate risk.

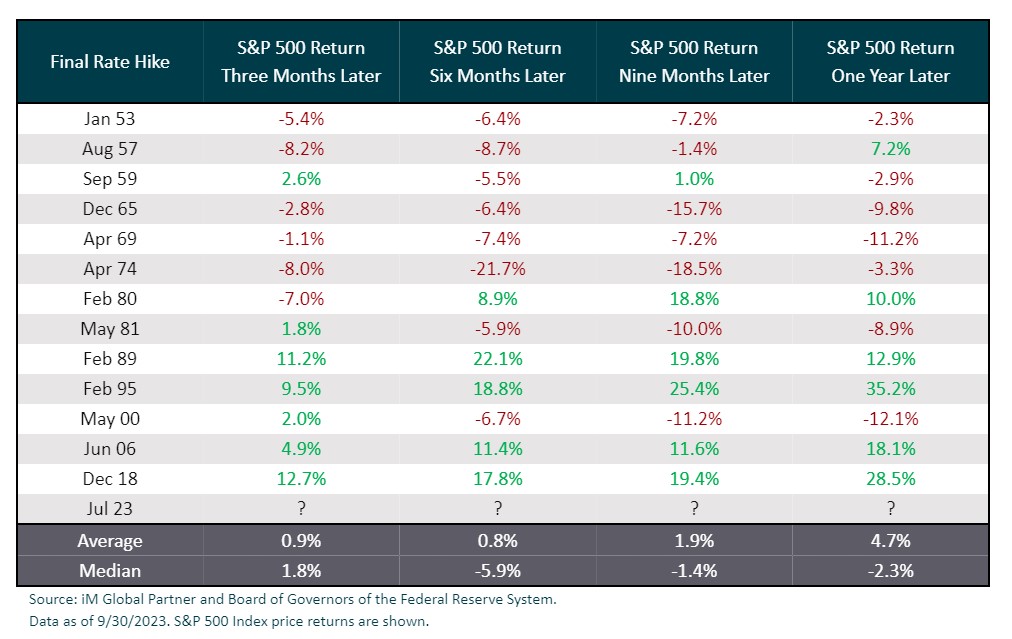

Historically, stock market returns over the next six to 12 months following a pause in a tightening cycle are mixed depending on the inflation environment. As we can see in the following chart, most of the negative outcomes occur during bouts of higher inflation when the Fed will typically maintain a more restrictive policy, i.e., it will take them longer to pivot and cut rates (i.e., pre-1980’s). On the other hand, when inflation is not elevated, the Fed can move to a more accommodative stance much sooner, leading to better equity market outcomes (i.e., post-1980’s).

Today, inflation remains elevated but on a clear path downwards. Of note, however, since the day of the Fed’s last rate hike (potentially) the S&P 500 began its current 7.5% drawdown. This may be a signal that the market expects inflation to persist and for the Fed to maintain interest rates “higher for longer.”

Within our portfolios, we maintain significant exposure to U.S. stocks overall and hold many of the mega cap tech stocks mentioned in this commentary through our equity mutual funds and ETFs. However, given the strong performance of the “Magnificent Seven,” we believe they are trading at expensive valuations and not adequately reflecting the recession we expect to play out over the next year or so. That said, other parts of the U.S. stock market are more reasonably valued, so we remain diversified across styles (i.e., growth, value, blend) and market caps (larger and smaller cap stocks) to take advantage of those opportunities.

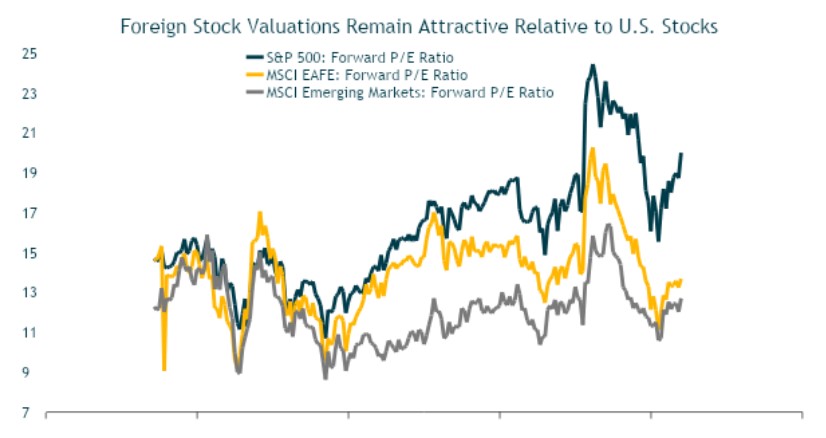

Overall, we remain slightly underweight the U.S. market in favor of foreign stocks. While it is true foreign stocks will likely decline as much as U.S. stocks in a recessionary scenario, foreign stocks are far less expensive than the U.S. setting them up for attractive medium-to-longer term expected returns.

Finally, our highest-conviction alternative strategy in terms of diversifying traditional assets remains managed futures, which have historically been able to generate positive returns during periods of losses for stocks and/or bonds. And in the case of standout years like 2022, when managed futures outperformed stocks by 45% and bonds by 40%, the diversification benefits can be meaningful.

Closing Thoughts

As we look ahead, a mild recession is still our base-case looking out to 2024. Of course, the timing and magnitude of the Fed’s response to economic data will be critical to the outcome. However, we can’t rule out the possibility that the Fed threads the economic needle and successfully guides us to the rare soft landing of lower inflation and slower economic growth without recession. Given the uncertainty, we expect volatility and we think that it will be more critical than ever to keep our pencils sharp and be ready to take advantage of market dislocations. This is not to suggest that we are changing our stripes as long-term investors. We continue to believe that taking a disciplined long-term view is the path to successful investing. We will maintain a balance of offense and defense, seeking attractive risk-reward opportunities that are supported by thorough analysis.

Thank you for your continued trust and confidence.