A lot has happened since the beginning of the year. The biggest macro event is Russia’s brutal invasion of Ukraine. While the human impact has been devastating and tragic—and our hearts and support are with the Ukrainian people—our job here is to focus here on the economic and financial market impact of this event.

It was a rough first quarter across the board, with stocks, bonds, U.S., international, and emerging markets all hurt by rising interest rates, inflation, and the war in Ukraine. Global stocks (MSCI ACWI Index) fell 5.4% for the quarter. Among major global markets, the S&P 500 was a relative outperformer, dropping 4.6%, compared to a 5.9% loss for developed international markets (MSCI EAFE Index) and a drop of 7.0% for Emerging Market (EM) stocks. The relatively mild declines for the full quarter masked the intra-quarter volatility, where peak-to-trough declines were much larger.

Unusually, the damage was worse in the U.S. core bond market than in the U.S. stock market. The benchmark Bloomberg U.S. Aggregate Bond Index (the “Agg”) fell 5.9% for the quarter. This was the second-worst quarter for the Agg since Q1 of 1980 when Paul Volcker’s Fed was in full-bore tightening mode. In the fixed-income markets outside of core bonds, high-yield (lower credit quality) bonds lost 4.5%, while floating-rate loans had just a 0.1% decline.

Portfolio Update Review

A period of rising inflation and rising interest rates creates challenges for both bonds and stocks, and in turn for a traditional balanced portfolio comprised only (or largely) of core bonds and stocks. Diversification into other asset classes, market segments, and alternative strategies can be particularly valuable in such an environment. To that point, trend-following managed futures strategies were the standout performers in our portfolios with the benchmark SG Trend Index gaining 17.9% for the quarter and posting gains in each month. Trends in interest rates and bonds have been a powerful contributor to their performance this year, a sharp contrast to the losses in investment-grade bonds.

In terms of our fixed-income allocation, our tactical positions inflexible, actively managed bond funds and floating-rate loan funds again added value relative to the core bond index from which the positions are funded, although they posted absolute losses. This was not surprising given the interest rate and credit market backdrop during the period, with Treasury yields sharply rising and corporate bond spreads widening.

On the downside, our tactical overweight to EM stocks detracted from relative performance. After a strong January, EM stocks gave up ground in the latter half of the quarter, trailing U.S. stocks and bonds. Our active EM fund managers, in aggregate, also trailed the EM index.

Investment Outlook Summary

The war in Ukraine has had wide-ranging but diverse impacts on the global economy and individual regions. Besides Ukraine itself, the most direct and damaging economic impact is on Russia. Given that Russia’s economy is less than 2% of global GDP and that our portfolios had close to zero exposure to Russian stocks or bonds, it is immaterial.

However, Russia is a major producer and exporter of oil and natural gas—to Europe in particular, accounting for roughly 50% of Europe’s natural gas imports and 25% of its oil imports—and certain agricultural commodities and base metals. As such, the war and the sanctions imposed on Russia by the West are having, and for the foreseeable future will continue to have, a material impact on global economic growth and inflation.

In a nutshell, the war is a “stagflationary” supply-shock: it fuels higher inflation via sharply rising commodity prices (especially oil) while also depressing economic growth via negative impacts on consumer spending. It is also triggering various government and central bank policy responses, which create additional risks and uncertainties for the economy and markets. In response to broadening and persistent inflation, the Federal Reserve has finally begun raising interest rates (the Fed funds policy rate).

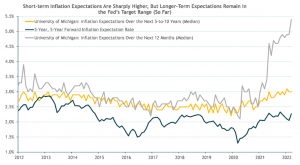

On the more positive side, longer-term inflation expectations remain mostly “anchored” in a range consistent with the Fed’s 2% long-term core inflation target. Short-term (12-month) inflation expectations have spiked higher, consistent with the recent sharp rise in gasoline prices and overall CPI, but over the medium-to-long-term expectations are that inflation will moderate. Should the longer-term measures move higher, we’d expect the Fed to accelerate its tightening pace.

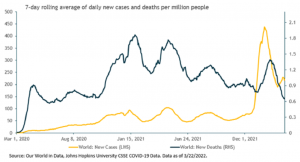

The COVID-19 pandemic is another wildcard but here the news has been getting better. Over time, with continued rising immunity rates and wide distributions of vaccines, the economic damage and disruption should continue to recede. If so, this should both support economic growth and mitigate some of the inflationary pressures the U.S. and global economy experienced over the past year caused by supply-chain bottlenecks and supply/demand mismatches for durable goods (e.g., autos).

Taking all factors into account, our base case shorter-term (12-month) economic outlook is for decelerating economic growth and still-high but moderating inflation. Absent a recession, which of course we can’t rule out, this macroeconomic backdrop should be generally supportive for “risk asset” returns, such as global equity and credit markets, and a headwind for core bonds in the face of rising government bond yields.

We’ve seen the latter play out so far this year, with sharply negative bond returns. Risk asset markets have also been generally negative, but not much worse than core bonds and in some cases better.

Closing Thoughts

The war in Ukraine has caused massive human suffering. From an economic and investment perspective, it has added to already-high uncertainty, degraded the near-term growth outlook, and added additional fuel to the inflationary fire. Crises, as painful as they are, often create opportunities. However, the equity and fixed-income markets have reacted quickly to the headlines, and as currently priced aren’t offering any compelling new top-down tactical asset allocation opportunities, in our view.

Our balanced portfolios remain positioned with (1) a small overweight to global equities, coming from our tactical overweight to EM stocks; (2) a large overweight to flexible, actively managed, credit-oriented fixed-income and floating-rate funds; (3) core positions in lower-risk and diversifying marketable alternative strategies; and (4) a large underweight to core bonds, but still meaningful allocations in our most conservative portfolios.

While tilting towards our highest-conviction tactical views, our portfolios remain strategically balanced and well-diversified across multiple global asset classes, investment strategies, equity styles, and risk-factor exposures.

This should enable them to be resilient should a risk scenario or shock outside our cautiously optimistic base case occur.

We are confident that our long-term, team-driven investment process, research depth and discipline, and access to exceptional managers will enable us to continue to navigate whatever macro and market environments come our way. We can all hope whatever comes next is not as grim as a pandemic or war. But as investors, we need to be prepared for the worse, even as we hope for the better.